Planning for your retirement probably feels like navigating uncharted territory if you’re like most individuals. You must consider so many important steps and variables when planning your retirement that it’s easy to get overwhelmed by the complexity of it all. Thankfully, our Arista Realty team is here to simplify the retirement planning process by providing the four most crucial steps to follow when envisioning your ideal retirement situation!

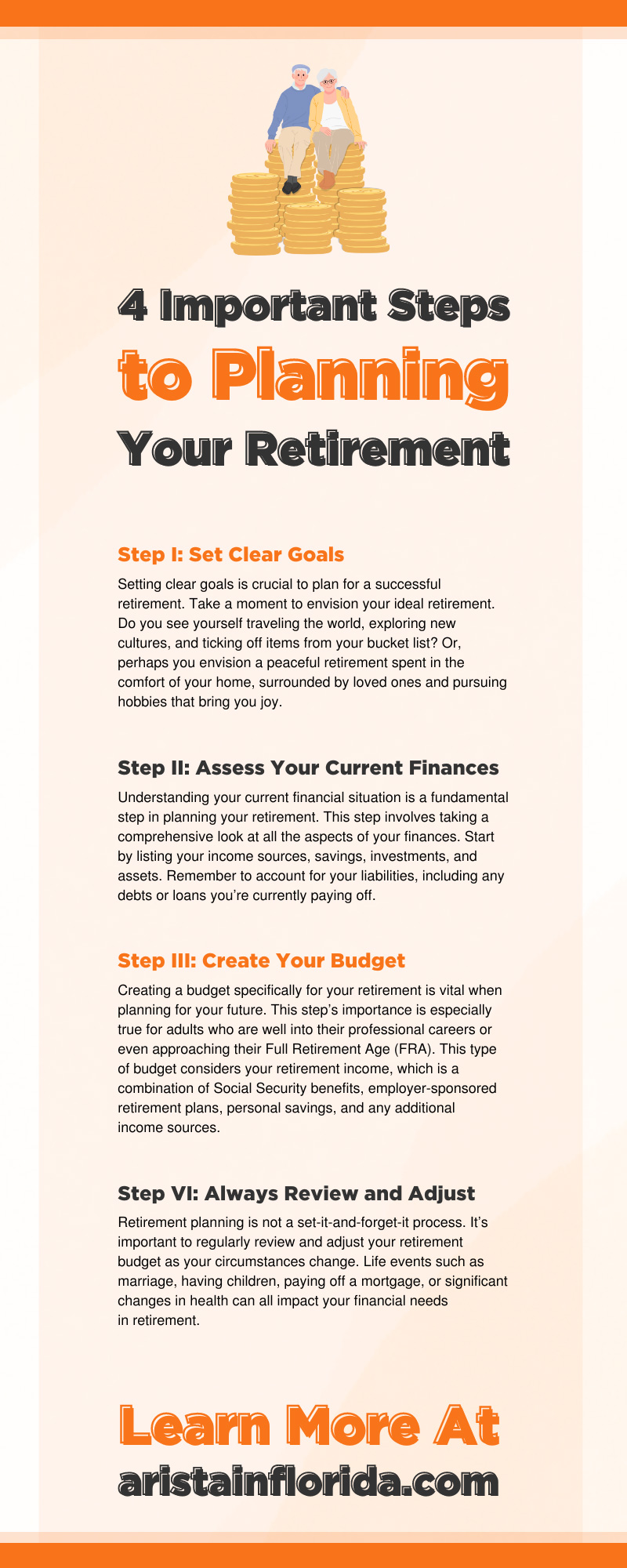

Step I: Set Clear Goals

Setting clear goals is crucial to plan for a successful retirement. Take a moment to envision your ideal retirement. Do you see yourself traveling the world, exploring new cultures, and ticking off items from your bucket list? Or, perhaps you envision a peaceful retirement spent in the comfort of your home, surrounded by loved ones and pursuing hobbies that bring you joy. Identifying what you want your retirement to look like will not only give you a sense of direction but also help you prioritize your financial planning efforts. Having a clear vision of your retirement will empower you to make informed decisions and shape a plan tailored to your unique aspirations, whether it’s seeking new experiences, enjoying leisurely activities, or strengthening relationships.

Step II: Assess Your Current Finances

Understanding your current financial situation is a fundamental step in planning your retirement. This step involves taking a comprehensive look at all the aspects of your finances. Start by listing your income sources, savings, investments, and assets. Remember to account for your liabilities, including any debts or loans you’re currently paying off. An accurate financial snapshot will give you an idea of where you stand today and how much ground you need to cover to meet your retirement goals. It’s essential to remain honest with yourself during this process. Remember, it’s not just about how much you’ve saved so far, it’s also about your spending habits, future expenses, and financial obligations. By thoroughly assessing your finances, you’ll better equip yourself to create a realistic and effective retirement plan.

Step III: Create Your Budget

Creating a budget specifically for your retirement is vital when planning for your future. This step’s importance is especially true for adults who are well into their professional careers or even approaching their Full Retirement Age (FRA). This type of budget considers your retirement income, which is a combination of Social Security benefits, employer-sponsored retirement plans, personal savings, and any additional income sources. Let’s dive into some of these retirement components and additional care factors worth considering in your plan.

Social Security Considerations

Social Security benefits will likely form a significant part of your retirement income. The amount you receive depends on the age at which you choose to start receiving benefits. For example, waiting until you reach Full Retirement Age (FRA) or even delaying beyond FRA can increase your monthly benefits significantly. Use the Social Security Administration’s online calculator to estimate your benefits at different ages.

Utilize Retirement Contribution Opportunities

Employer-sponsored retirement plans like 401(k)s or traditional pensions are another key income source. Maximize your contributions to these plans if you’re still working, especially if your employer offers matching contributions. Consider your current balance, ongoing contributions, your employer’s match, and the average return rate on your investments for defined contribution plans like a 401(k) to estimate your income from this source.

Diversify Your Retirement Portfolio

Personal savings and investments outside of your employer-sponsored plans can provide additional income in retirement. This additional income could include IRAs, stocks, bonds, mutual funds, and savings accounts. Diversifying your portfolio across various assets can help manage risk and increase your returns. Keep in mind that all investments carry some level of risk, and making conservative estimates for rates of return is important.

Long-Term Care Considerations

Lastly, consider the potential cost of long-term care. Our likelihood of needing some form of long-term care increases as we age. This type of care could be in-home care, assisted living, or nursing home care. These costs can significantly impact your retirement budget. Ensure these potential costs don’t derail your retirement plans by including a plan for long-term care, whether you apply for long-term care insurance or set aside a specific amount in savings.

Calculating the Ideal Retirement Income

Now that you understand the many factors that comprise a retirement budget and plan, you can accurately calculate the ideal retirement income for your golden years! First, the general rule of thumb suggests that you’ll need about 70-80% of your pre-retirement income to maintain your current lifestyle in retirement. For instance, you’d aim for an annual retirement income of around $70,000 to $80,000 if you’re currently earning $100,000 annually.

Suppose you’re eligible for full Social Security benefits at your FRA, roughly $2,500 a month or $30,000 per year. Then, let’s say you have a 401(k) balance of $700,000. Following the safe withdrawal rate of 4% per year would provide an additional $28,000 per year. Finally, suppose you have an IRA with a balance of $300,000. The same 4% withdrawal rate would provide another $12,000 per year. Your total retirement income from these sources would be $70,000 annually, which falls perfectly within your target range of $70,000 to $80,000.

Step VI: Always Review and Adjust

Retirement planning is not a set-it-and-forget-it process. It’s important to regularly review and adjust your retirement budget as your circumstances change. Life events such as marriage, having children, paying off a mortgage, or significant changes in health can all impact your financial needs in retirement. Additionally, market conditions can affect the value of your investments, and inflation can erode your purchasing power over time.

For example, your living expenses will have decreased significantly if you’ve recently paid off your mortgage, allowing you to save more toward retirement. Conversely, a downturn in the market might reduce the value of your 401(k) or IRA, necessitating an increase in contributions or a delay in retirement. Regularly reviewing your retirement plan allows you to make these adjustments promptly, ensuring you stay on track toward achieving your retirement income goals. Reviewing your retirement budget at least once a year or whenever you experience a significant life or financial change is generally advisable.

Understanding the four important steps required for planning a successful retirement ensures your golden years are enjoyable and comfortable! Check out our selection of homes for sale in Central Florida, all located in active adult communities designed to enrich your retirement, when you’re ready to start this new chapter in your life.